Future of Investment Banking in India: How NISM Certifications Boost Careers in Capital Markets

Investment banking in India is evolving rapidly—and with that comes a surge in demand for certified, knowledgeable professionals. If you're dreaming of a career in this fast-paced, high-stakes domain, you’ll need more than ambition. You’ll need the right skills, the right mindset, and the right certifications.

This blog explores how NISM certifications are becoming increasingly relevant for those aiming to break into investment banking, especially in the Indian context between 2025– 2030.

1. Growth of Investment Banking in India (2025–2030)

India’s investment banking landscape is expected to grow significantly due to:

• Increasing IPO activity from startups and mid-cap firms

• Government-led initiatives like disinvestment and infrastructure funding

• Rising demand for M&A advisory, ECM, and DCM services

• India’s increasing integration with global capital markets

With this growth, the need for well-trained professionals in areas like equity research, capital markets, compliance, and trading desks will surge.

2. Top Skills Required for a Career in Investment Banking

To thrive in investment banking, you'll need a powerful mix of technical and regulatory knowledge, such as:

• Financial modeling & valuation

• M&A and capital raising processes

• Equity, derivatives, and debt market knowledge

• Regulatory compliance (SEBI norms)

• Strong analytical, Excel, and communication skills

This is where NISM certifications come in—they lay the regulatory and functional foundation needed for such roles.

3. NISM Certifications for Investment Bankers

While CFA and MBA programs offer in-depth global finance exposure, NISM is your best bet if you’re focusing on Indian capital markets and investment banking roles.

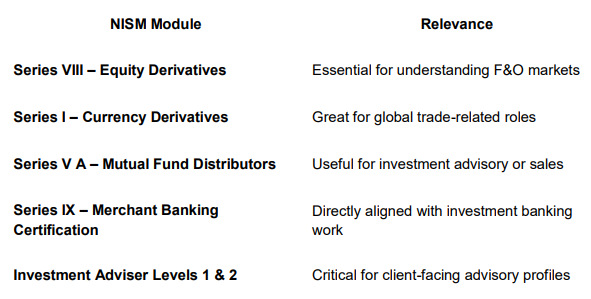

Recommended NISM Modules:

Explore all modules on our Product Page and get started today!

4. How Mock Tests Prepare You for Banking Sector Exams

Even if you're a finance graduate, cracking NISM exams requires exam-specific strategy and practice. That’s where mock tests make a big difference:

• Build confidence under exam conditions

• Practice time management and accuracy

• Understand complex concepts with detailed solutions

• Identify weak topics and track your improvement

Take your first Free Demo Mock Test and experience our exam-style interface, built to mirror real NISM exams.

5. High-Paying Jobs After Completing NISM Certifications

NISM certification opens doors to well-paying roles in:

• Investment banking operations

• Equity dealing & research

• Wealth management & portfolio advisory

• Compliance and regulatory audit

• Capital markets strategy roles

Starting salaries range from Rs. 4–7 LPA for freshers and can go up to Rs. 15–25 LPA+ with experience and multiple certifications. Hear it from our successful candidates—read more on our Testimonial Page!

FAQs – NISM & Investment Banking Careers

1. Which NISM exam is best for investment banking?

Start with Series IX – Merchant Banking and Series VIII – Equity Derivatives for direct relevance. Investment Adviser modules are great for client-facing roles.

2. What are the salary prospects after NISM certification?

Entry-level roles start at ?4–6 LPA. With 2–3 certifications and experience, you can target ?10–20 LPA in top investment firms.

3. Is NISM certification mandatory for investment banking jobs?

It’s not always mandatory for all IB roles, but highly preferred for jobs related to trading, compliance, research, and client advisory in capital markets.

4. How long does it take to complete NISM certification?

Each module takes about 2–4 weeks of focused preparation. You can attempt multiple modules over a few months.

5. Do investment banks in India prefer NISM-certified professionals?

Yes—especially for roles in capital markets, operations, compliance, and advisory. It shows you’re market-ready and SEBI-compliant.

Final Thoughts

The future of investment banking in India looks bright, and there’s room for professionals who are certified, skilled, and regulation-aware. With the right NISM modules and preparation tools, you’ll be far better equipped to land your dream job in this competitive industry.

♦ Start Now: Explore our full NISM Certification Courses or take a Free Demo Mock Test to begin your journey.

♦ Still have questions? Contact Us—we’re here to help you every step of the way!